All Categories

Featured

Table of Contents

- – Exceptional Accredited Investor Funding Opport...

- – Accredited Investor Passive Income Programs

- – Best-In-Class Passive Income For Accredited I...

- – Specialist Exclusive Investment Platforms For...

- – Professional Exclusive Investment Platforms ...

- – Cutting-Edge Accredited Investor Property In...

- – Accredited Investor Alternative Asset Invest...

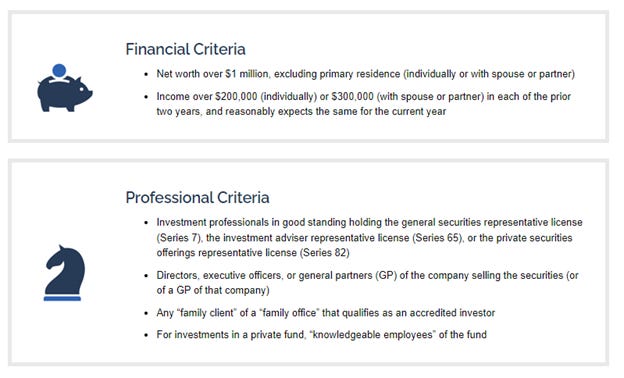

The guidelines for accredited financiers vary among territories. In the U.S, the interpretation of a recognized investor is presented by the SEC in Regulation 501 of Policy D. To be a certified capitalist, an individual has to have a yearly earnings going beyond $200,000 ($300,000 for joint earnings) for the last 2 years with the assumption of earning the same or a greater earnings in the present year.

This amount can not include a key residence., executive police officers, or supervisors of a company that is providing unregistered protections.

Exceptional Accredited Investor Funding Opportunities

Also, if an entity consists of equity owners who are recognized investors, the entity itself is a recognized capitalist. A company can not be created with the single objective of buying specific safeties. An individual can qualify as an approved investor by showing enough education or task experience in the economic industry

Individuals that want to be recognized financiers don't put on the SEC for the designation. Rather, it is the responsibility of the business offering a personal placement to make sure that all of those come close to are recognized financiers. Individuals or celebrations who want to be certified financiers can approach the provider of the unregistered protections.

Expect there is a private whose earnings was $150,000 for the last three years. They reported a main residence value of $1 million (with a home loan of $200,000), an automobile worth $100,000 (with a superior loan of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Web worth is calculated as properties minus responsibilities. This individual's net well worth is precisely $1 million. This entails an estimation of their possessions (aside from their key house) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equating to $50,000. Since they meet the web worth need, they qualify to be an accredited capitalist.

Accredited Investor Passive Income Programs

There are a couple of much less usual credentials, such as handling a depend on with greater than $5 million in possessions. Under federal protections legislations, only those who are approved financiers might participate in certain safety and securities offerings. These might include shares in private positionings, structured items, and personal equity or hedge funds, to name a few.

The regulatory authorities desire to be certain that individuals in these very dangerous and intricate financial investments can fend for themselves and evaluate the dangers in the absence of government defense. The certified capitalist regulations are made to secure potential financiers with restricted monetary expertise from dangerous endeavors and losses they might be unwell geared up to stand up to.

Recognized investors fulfill credentials and professional requirements to accessibility exclusive financial investment opportunities. Certified financiers should meet earnings and net worth demands, unlike non-accredited people, and can invest without limitations.

Best-In-Class Passive Income For Accredited Investors

Some vital modifications made in 2020 by the SEC consist of:. This adjustment acknowledges that these entity types are commonly utilized for making financial investments.

These changes expand the accredited investor swimming pool by approximately 64 million Americans. This broader access supplies much more chances for capitalists, yet additionally increases prospective threats as much less financially advanced, investors can take part.

One major benefit is the chance to buy placements and hedge funds. These financial investment alternatives are exclusive to recognized financiers and organizations that qualify as a certified, per SEC guidelines. Personal placements allow business to secure funds without browsing the IPO procedure and regulative documentation required for offerings. This provides recognized financiers the opportunity to buy arising business at a phase before they consider going public.

Specialist Exclusive Investment Platforms For Accredited Investors for High-Yield Investments

They are deemed investments and come only, to qualified clients. Along with recognized firms, certified capitalists can pick to purchase startups and up-and-coming endeavors. This offers them income tax return and the possibility to get in at an earlier stage and potentially reap benefits if the company thrives.

For investors open to the dangers entailed, backing start-ups can lead to gains (accredited investor investment returns). Much of today's tech companies such as Facebook, Uber and Airbnb came from as early-stage startups sustained by certified angel financiers. Innovative capitalists have the chance to check out financial investment choices that might generate a lot more earnings than what public markets use

Professional Exclusive Investment Platforms For Accredited Investors

Although returns are not assured, diversification and portfolio improvement alternatives are expanded for investors. By diversifying their portfolios through these broadened investment opportunities approved financiers can enhance their methods and possibly attain premium lasting returns with correct threat monitoring. Experienced financiers usually encounter financial investment choices that may not be conveniently available to the basic investor.

Financial investment choices and protections provided to accredited capitalists usually entail higher risks. Personal equity, venture resources and bush funds commonly focus on spending in assets that carry threat yet can be sold off conveniently for the opportunity of higher returns on those high-risk financial investments. Investigating prior to spending is essential these in situations.

Lock up durations prevent investors from withdrawing funds for even more months and years on end. Capitalists may struggle to accurately value personal assets.

Cutting-Edge Accredited Investor Property Investment Deals

This adjustment might expand certified financier status to an array of individuals. Permitting partners in committed connections to incorporate their resources for common qualification as recognized investors.

Enabling people with specific professional certifications, such as Collection 7 or CFA, to certify as accredited financiers. This would certainly recognize economic class. Creating extra needs such as proof of economic literacy or successfully completing an accredited investor examination. This might make certain capitalists recognize the dangers. Restricting or eliminating the main home from the total assets estimation to lower potentially filled with air evaluations of wide range.

On the other hand, it might additionally result in knowledgeable financiers presuming excessive threats that may not be appropriate for them. Existing accredited investors might encounter increased competition for the best financial investment possibilities if the swimming pool grows.

Accredited Investor Alternative Asset Investments

Those that are presently considered accredited financiers have to remain updated on any alterations to the criteria and policies. Their eligibility could be subject to adjustments in the future. To keep their condition as accredited capitalists under a modified definition adjustments may be necessary in wealth administration tactics. Companies seeking accredited investors need to remain alert about these updates to ensure they are drawing in the right target market of capitalists.

Table of Contents

- – Exceptional Accredited Investor Funding Opport...

- – Accredited Investor Passive Income Programs

- – Best-In-Class Passive Income For Accredited I...

- – Specialist Exclusive Investment Platforms For...

- – Professional Exclusive Investment Platforms ...

- – Cutting-Edge Accredited Investor Property In...

- – Accredited Investor Alternative Asset Invest...

Latest Posts

Homes For Back Taxes

Buying Delinquent Tax Homes

Property Tax Lien Investing

More

Latest Posts

Homes For Back Taxes

Buying Delinquent Tax Homes

Property Tax Lien Investing